If you have been paid late on an invoice rendered commercially, then your business could be entitled to compensation from the debtor under the Late Payment of Commercial Debts (Interest) Act 1998. enclose a Financial Statement form (an example Financial Statement is provided in Annex 2 to the Pre-action Protocol for Debt Claims – the Statement is part of the Standard Financial Statement and can be downloaded from ).enclose a copy of the Information Sheet and the Reply Form at Annex 1 to the Pre-action Protocol for Debt Claims and.where no statements have been provided for the debt, state in the Letter of Claim the amount of interest incurred and any administrative or other charges imposed since the debt was incurred.enclose the most recent statement of account for the debt and state in the Letter of Claim the amount of interest incurred and any administrative or other charges imposed since that statement of account was issued, sufficient to bring it up to date.enclose an up-to-date statement of account for the debt, which should include details of any interest and administrative or other charges added.the address to which the completed Reply Form should be sent.

#OUTSTANDING INVOICES LETTER TEMPLATE HOW TO#

details of how the debt can be paid (for example, the method of and address for payment) and details of how to proceed if the debtor wishes to discuss payment options.if regular instalments are currently being offered by or on behalf of the debtor, or are being paid, an explanation of why the offer is not acceptable and why a court claim is still being considered.where the debt has been assigned, the details of the original debt and creditor, when it was assigned and to whom.

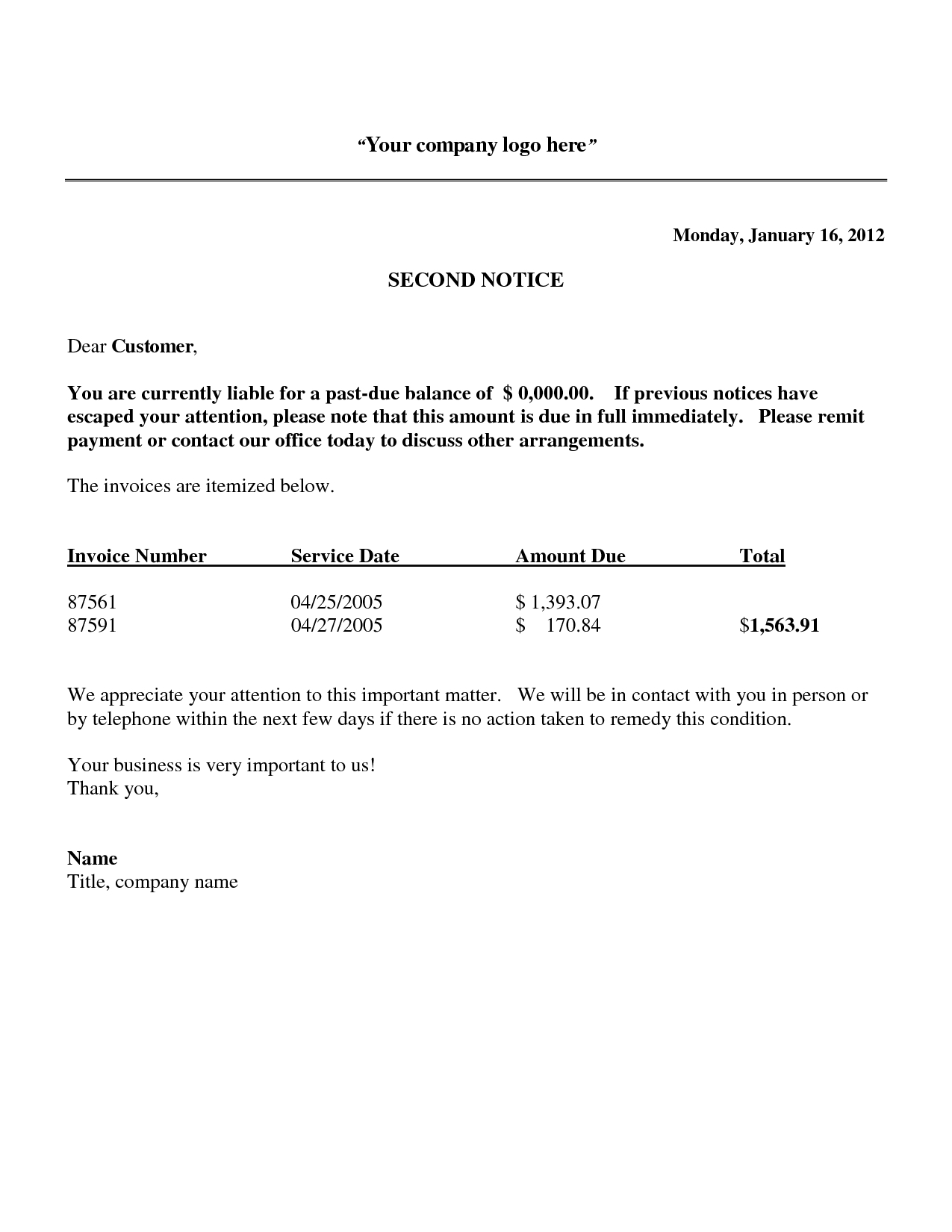

What if your client won’t pay an unpaid invoice: Letter of Claimīefore court proceedings are commenced, a creditor should consider sending a Letter of Claim to the debtor.

#OUTSTANDING INVOICES LETTER TEMPLATE PLUS#

Luckily for our clients this means instructing us to pursue their bad debts has ultimately recovered the sums owed plus interest with a refund of their legal costs.

This has also meant that the petitioned company or individual has paid our fees. To date, we have a 100% success rate and all of the petitions we have issued have been resolved in our client’s favour. There are many ways to get money owed for an overdue invoice.

Should the debtor still not pay, then a creditor has the option to petition the court to wind up the company. Should this be fruitless, then a statutory demand can be issued (which is the pre-cursor to legal action for an unpaid invoice). In some circumstances, a warning letter or email from solicitors will induce a debtor company to pay what is owed. A creditor’s approach to debt recovery will vary depending on the individual circumstances of the case. If you have rendered an invoice to a client or customer company, and the debtor has not paid the invoice, then you will need to consider debt recovery options.

0 kommentar(er)

0 kommentar(er)